レポートの一覧に戻る

Navigating Challenges and Opportunities: ANA's Performance Over the Last Three Years

🗓 Created on 9/26/2024

📜 要約

Summary of Topic and Purpose

This investigation focuses on analyzing the recent financial performance of All Nippon Airways (ANA), Japan's largest airline, and comparing it to other major global airlines. The primary objectives are to:

- Examine ANA's financial results from 2021 to 2023, highlighting the company's recovery and key trends.

- Compare ANA's performance with its domestic and international competitors, identifying its strengths, weaknesses, and market positioning.

- Assess the current challenges and market trends facing the airline industry in Japan, particularly the impact of low-cost carriers and regulatory constraints.

- Outline ANA's strategic initiatives for future growth, including its plans for business structure reforms, diversification, and sustainable development.

Key Findings and Insights

- ANA's financial performance has shown a significant recovery, particularly in the first quarter of FY2023, with a consolidated operating profit of 43.7 billion yen. This turnaround was driven by a surge in international revenue (up 170%) and a 40% increase in domestic revenue, despite a 60% drop in cargo revenue.

- Compared to its domestic competitor, Japan Airlines (JAL), ANA faces higher interest-bearing debt and a cost structure that negatively impacts profitability. JAL has demonstrated a stronger recovery, focusing on operational efficiency and service quality.

- The Japanese airline market is characterized by a duopoly between ANA and JAL, resulting in limited competition and high fares. In contrast, European and American markets have seen increased competition and lower fares due to the rise of low-cost carriers and deregulation.

- Key challenges facing the Japanese airline industry include a lack of fare flexibility, high base fares, and regulatory constraints that restrict airlines from adjusting fares based on demand. Recommendations suggest abolishing the pre-approval system for fares and encouraging more low-cost carriers to enhance competition.

- ANA's strategic initiatives for future growth focus on enhancing the Air Transportation Business, diversifying into non-airline profit domains, and developing the ANA Economic Zone for sustainable growth. The company aims to improve its financial discipline, digital transformation, and environmental sustainability.

Summary of Results and Conclusions

The analysis of ANA's recent performance and the broader Japanese airline industry highlights several key findings:

- ANA has demonstrated a strong recovery in its financial results, particularly in the international and domestic passenger segments, despite ongoing challenges in the cargo business.

- Compared to its domestic competitor JAL, ANA faces higher costs and debt levels, which impact its profitability, underscoring the need for continued operational and financial optimization.

- The Japanese airline market remains largely oligopolistic, with limited competition and high fares, in contrast to more deregulated markets. Regulatory reforms to encourage greater competition and fare flexibility are necessary to improve the industry's dynamics.

- ANA's strategic initiatives focus on diversification, digital transformation, and sustainability, aiming to enhance its market position and financial performance in the post-COVID-19 era. The successful execution of these plans will be crucial for the company's long-term growth and competitiveness.

このレポートが参考になりましたか?

あなたの仕事の調査業務をワンボタンでレポートにできます。

🔍 詳細

🏷Overview of All Nippon Airways (ANA)

Overview of All Nippon Airways (ANA)

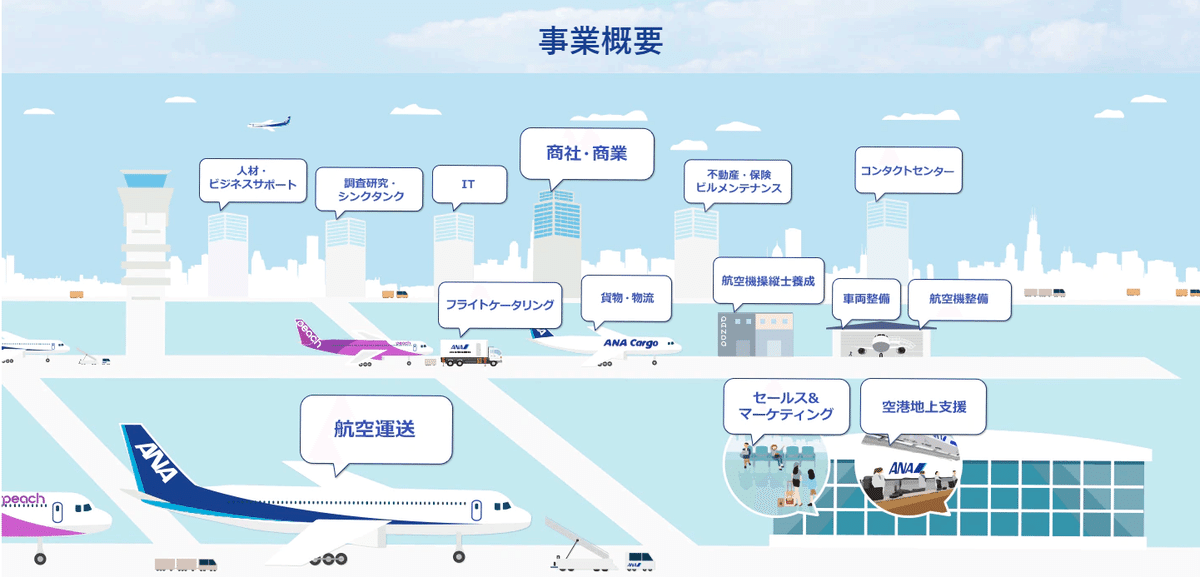

All Nippon Airways (ANA) is a leading airline in Japan, recognized for its excellence in both domestic and international markets, particularly in Asia. The airline has adopted a multi-brand strategy to compete with low-cost carriers (LCCs), maintaining its full-service brand while catering to budget travelers. ANA has received high accolades, including a 5-star rating from SKYTRAX, reflecting its commitment to quality and innovation, such as the introduction of all-aisle access in business class. The airline's reputation is bolstered by its focus on enhancing customer experience and operational efficiency. As it navigates the challenges posed by LCCs and the evolving aviation landscape, ANA continues to prioritize brand value enhancement and customer satisfaction.

Detailed Information on All Nippon Airways (ANA)

-

Management Vision: The ANA Group aims to "Unite the World in Wonder," inspiring employees and customers to explore endless possibilities through diverse connections that begin in the sky.

-

Business Recovery Post-COVID-19: Fiscal 2022 marked a turning point for ANA as it returned to profitability for the first time in three years, overcoming unprecedented challenges posed by the pandemic. The report reflects on the importance of employee engagement and collaboration in achieving this recovery.

-

Sustainability Initiatives: ANA is committed to enhancing its Environmental, Social, and Governance (ESG) management. The report outlines specific targets for reducing CO2 emissions, including a goal to replace at least 10% of fuel with sustainable aviation fuel (SAF) by FY2030 and achieving net-zero emissions by FY2050.

-

Human Capital Management: Recognizing the importance of its workforce, ANA emphasizes the need for human capital development, diversity, equity, and inclusion (DEI) initiatives. The company aims to create a supportive work environment that maximizes employee potential.

-

Financial Performance: The report details financial targets for FY2023-2025, including projected operating revenues and income, with a focus on maximizing profits in both airline and non-airline businesses.

-

New Brand Launch: ANA is set to introduce a new airline brand, AirJapan, aimed at capturing the growing demand for travel in Asia, particularly from Southeast Asia to Japan.

-

Digital Transformation: The report discusses ANA's commitment to digital transformation, enhancing customer experience through technology and data utilization.

-

Stakeholder Engagement: ANA emphasizes the importance of building trust with stakeholders, including customers, employees, and investors, to foster long-term relationships and sustainable growth.

For further details, please refer to the full report available at the ANA Group's corporate website: ANA Group Corporate Website.

-

Reputation: Known as ANA, this airline is recognized as a leading representative of Japan, excelling in both domestic and international markets, particularly in Asia.

-

Multi-Brand Strategy: To combat the rise of low-cost carriers (LCCs), ANA has adopted a multi-brand strategy, allowing it to maintain its full-service brand while also catering to the budget market.

-

Global Recognition: ANA has received high accolades, including a 5-star rating from SKYTRAX in 2013, maintaining this status for four consecutive years. Innovations such as the introduction of all-aisle access in business class in 2010 highlight its commitment to quality.

For more insights on the differences between ANA and Japan Airlines (JAL), you can visit .

kenjasyukatsu.com

🏷Financial Performance Analysis: 2021-2023

Financial Performance Analysis: 2021-2023

ANA's financial performance from 2021 to 2023 has shown a significant recovery, particularly in the first quarter of FY2023, where the airline reported a consolidated operating profit of 43.7 billion yen, a turnaround from a loss in the previous year. The international revenue surged by 170%, reaching 167.3 billion yen, while domestic revenue increased by 40%. Despite challenges in cargo revenue, which saw a 60% drop due to decreased demand, ANA's overall financial outlook remains positive, with a projected net profit of 80 billion yen for the full year. The airline's strategic focus on sustainable growth and effective cost management has contributed to this recovery, despite ongoing geopolitical risks and the lingering effects of the COVID-19 pandemic.

Overview of ANA's Q1 Performance

All Nippon Airways (ANA) has reported a profitable first quarter for the first time in four years, driven by a significant increase in passenger traffic both domestically and internationally.

- International Revenue Surge: ANA's international revenue nearly tripled compared to the previous year, reaching 167.3 billion yen ($1.18 billion), a 170% increase.

- Domestic Revenue Growth: Domestic revenue rose by 40%, with over 9.6 million passengers carried, marking a 47% improvement from last year.

Financial Highlights

- Operating Profit: ANA posted a consolidated operating profit of 43.7 billion yen ($309.6 million) for Q1 FY2023 (April-June), a turnaround from a loss of 1.3 billion yen ($9.2 million) in the same period in 2022.

- Net Profit: The airline's net profit for the quarter stood at 30.6 billion yen ($216.8 million).

Strategic Insights

Kimihiro Nakahori, Executive Vice President and Group Chief Financial Officer, emphasized that the quarter's performance reflects ANA's strategy for sustainable growth post-restrictions. The airline's profitability is attributed to effective cost management despite rising variable costs.

Passenger Traffic Recovery

- International Passengers: The airline carried 1.62 million international passengers, a 2.4 times increase from last year, with a load factor of 77.2%, up 6.5 points from 2022.

- Domestic Performance: The domestic load factor improved from 53.9% in 2022 to 66.9%, although business demand remains around 60% of pre-COVID levels.

Cargo Revenue Challenges

Despite a 20% decrease in cargo volume, revenue dropped by 60% due to reduced demand in key industries like semiconductors and automotive. However, cargo revenues are still 50% higher than in 2019, with unit prices up by 80%.

Future Outlook

ANA has maintained its full-year earnings forecast, projecting a net profit of 80 billion yen ($566.8 million). CEO Shinichi Inoue noted that the pandemic's impact continues to affect the industry, particularly for East Asian carriers facing challenges from the ongoing Russia-Ukraine conflict.

For more details, visit Simple Flying.

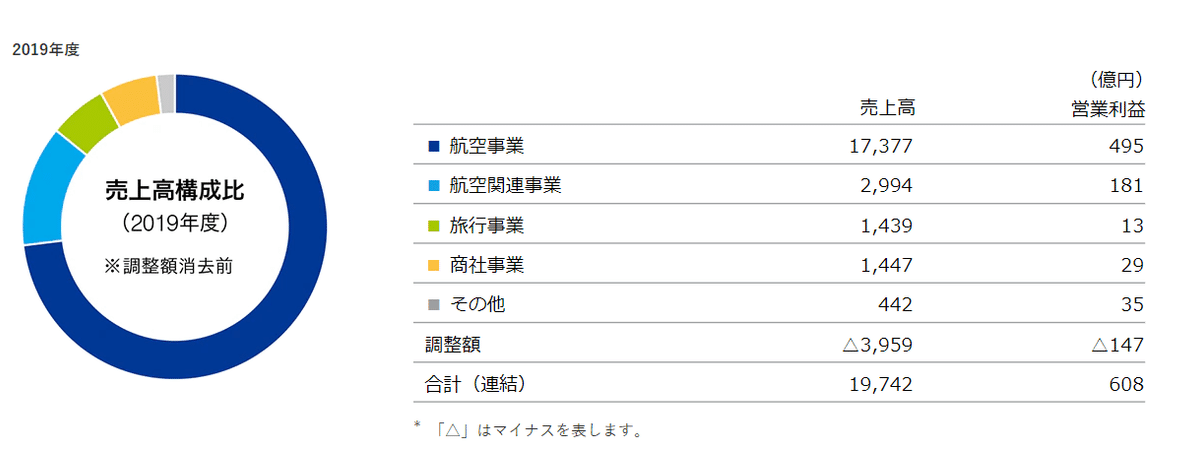

ANA Company Overview

ANA (All Nippon Airways) is currently facing significant challenges, primarily due to the ongoing impact of the COVID-19 pandemic. The company's financial situation has deteriorated, with a reported revenue of approximately 740 billion yen for the fiscal year ending March 2022, resulting in a loss of around 100 billion yen. This marks the second consecutive year of losses, following a loss of approximately 400 billion yen in 2020. Prior to the pandemic, ANA had annual revenues of 2 trillion yen and a net profit of about 150 billion yen.

Financial Challenges

- Declining Stock Prices: The pandemic has led to a significant drop in ANA's stock price, which has halved since the onset of COVID-19. This decline reflects a lack of investor confidence in the company's future prospects.

- Workforce Reduction: ANA plans to reduce its workforce from approximately 38,000 employees at the end of FY2020 to about 29,000 by the end of FY2025. This reduction indicates a shift in operational strategy post-COVID, as the company can no longer maintain its previous staffing levels. Employees have been reassigned to external companies, such as cabin crew working in call centers.

Strengths of ANA

Despite the challenges, ANA remains a leading airline in Japan, with a competitive edge over its rival, JAL (Japan Airlines). In FY2018, ANA generated 2 trillion yen in revenue compared to JAL's 1.4 trillion yen.

- Innovative Spirit: ANA has a history of pioneering initiatives in the airline industry, such as the early adoption of web check-in services and the introduction of the Boeing 787, known for its superior handling and comfort.

- Diverse Business Ventures: ANA has expanded into various sectors beyond aviation, including advertising through its travel media. The airline utilizes its extensive customer contact points to offer advertising opportunities, providing a comprehensive service from planning to reporting.

Weaknesses of ANA

- Financial Instability: Compared to JAL, ANA has a higher level of debt, which poses a risk to its financial health. As of June 2020, ANA's interest-bearing debt stood at 1.3589 trillion yen, with a capital ratio of 33.9%, while JAL's figures were significantly lower.

- Changing Demand: The pandemic has altered consumer behavior, with a decline in business travel due to the normalization of online meetings. This shift has led many companies to reduce travel expenses, impacting ANA's revenue potential.

Advice for Job Seekers

While ANA faces numerous risks, it has made significant contributions to Japan's aviation industry. Prospective employees should be aware of these challenges but also recognize the potential for growth and contribution within the company. ANA is open to applicants who wish to join, even allowing those who graduated after 2019 to apply for positions in 2023.

For more information on ANA's corporate structure and opportunities, visit ANA Group.

ANA Group's Performance | Investor Information

The ANA Group has reported significant financial results for the fiscal year ending March 2024, achieving record profits. Despite geopolitical risks related to the Ukraine and Middle East situations, passenger demand continues to recover.

- Sales Revenue: The total sales revenue reached 2.0559 trillion yen, marking a 20.4% increase compared to the previous year.

- Operating Profit: Operating profit soared to 207.9 billion yen, a remarkable 73.2% increase year-on-year.

- Ordinary Profit: Ordinary profit also saw a substantial rise to 207.6 billion yen, up 85.7% from the previous year.

- Net Profit: The net profit attributable to shareholders was 157 billion yen, reflecting a 75.6% increase.

Consolidated Financial Results

| Item | FY2023 Actual | FY2024 Actual | Difference | Change Rate (%) |

|---|---|---|---|---|

| Sales Revenue | 1.7074 trillion yen | 2.0559 trillion yen | 348.4 billion yen | 20.4 |

| Operating Expenses | 1.5874 trillion yen | 1.8480 trillion yen | 260.5 billion yen | 16.4 |

| Operating Profit | 120 billion yen | 207.9 billion yen | 87.8 billion yen | 73.2 |

| Ordinary Profit | 111.8 billion yen | 207.6 billion yen | 95.8 billion yen | 85.7 |

| Net Profit | 89.4 billion yen | 157 billion yen | 67.6 billion yen | 75.6 |

| EBITDA* | 264.3 billion yen | 350.2 billion yen | 80.8 billion yen | - |

*EBITDA = Operating Profit + Depreciation Expenses

FY2025 Forecast (Revised on April 26, 2024)

Looking ahead, the Japanese economy is expected to improve in terms of employment and income, leading to a gradual recovery. However, global economic risks remain due to financial tightening and concerns about the Chinese economy.

In this context, the ANA Group will continue to implement its mid-term management strategy for 2023-2025, aiming to fulfill its management vision of "a world filled with excitement." The group will focus on creating diverse connections between new regions while prioritizing employee well-being and providing new value to various stakeholders, including shareholders.

| FY2025 Forecast (Consolidated) | Estimate | Previous Year Actual (FY2023) | Difference |

|---|---|---|---|

| Sales Revenue | 2.190 trillion yen | 2.0559 trillion yen | 134 billion yen |

| Operating Profit | 170 billion yen | 207.9 billion yen | -37.9 billion yen |

| Ordinary Profit | 160 billion yen | 207.6 billion yen | -47.6 billion yen |

| Net Profit | 110 billion yen | 157 billion yen | -47 billion yen |

For more detailed information, please refer to the official document here.

🏷Market Comparison: ANA vs. Global Airlines

Market Comparison: ANA vs. Global Airlines

The comparison between All Nippon Airways (ANA) and global airlines highlights several key aspects of their performance and market positioning. ANA, despite being the largest airline in Japan, faces significant challenges, including high interest-bearing debt and a cost structure that negatively impacts profitability. In contrast, Japan Airlines (JAL) has demonstrated a notable recovery since its re-listing, focusing on operational efficiency and service quality, which has improved its profitability. The aviation industry is witnessing a recovery in passenger demand post-COVID-19, with both ANA and JAL adapting to new market conditions. The competition from low-cost carriers (LCC) is also reshaping the landscape, as these airlines attract cost-conscious travelers. Overall, ANA's performance is under scrutiny as it navigates these challenges while striving to maintain its market position against both domestic and international competitors.

Analysis of JAL and ANA: Significant Differences in Profitability

The analysis of Japan Airlines (JAL) and All Nippon Airways (ANA) reveals a notable disparity in their profitability. This difference can be attributed to various operational and financial factors.

-

Cost of Sales Ratio: JAL's cost of sales ratio stands at 80.0%, while ANA's is higher at 83.2%. Given their substantial revenues, even a slight difference in these percentages can lead to significant variations in profit margins.

-

JAL's Recovery and Efficiency: Since JAL's re-listing two years ago, the airline has focused on streamlining operations and enhancing service quality following its bankruptcy. This restructuring has led to improved profitability, aided by tax advantages from its corporate rehabilitation process.

-

ANA's Challenges: Despite being the largest airline in Japan, ANA struggles with high interest-bearing debt and a cost structure that hampers profitability. This situation raises questions about the sustainability of its current financial health.

-

Recent Financial Performance: In the first quarter of the fiscal year ending March 2015, JAL reported a 4.4% increase in operating revenue to 307 billion yen, driven by rising international demand. However, increased fuel costs led to a 5.8% rise in operating expenses to 245.5 billion yen, resulting in a slight decrease in operating profit by 15.6% to 18.6 billion yen.

For further details, refer to the financial statements and analysis provided in the original article here.

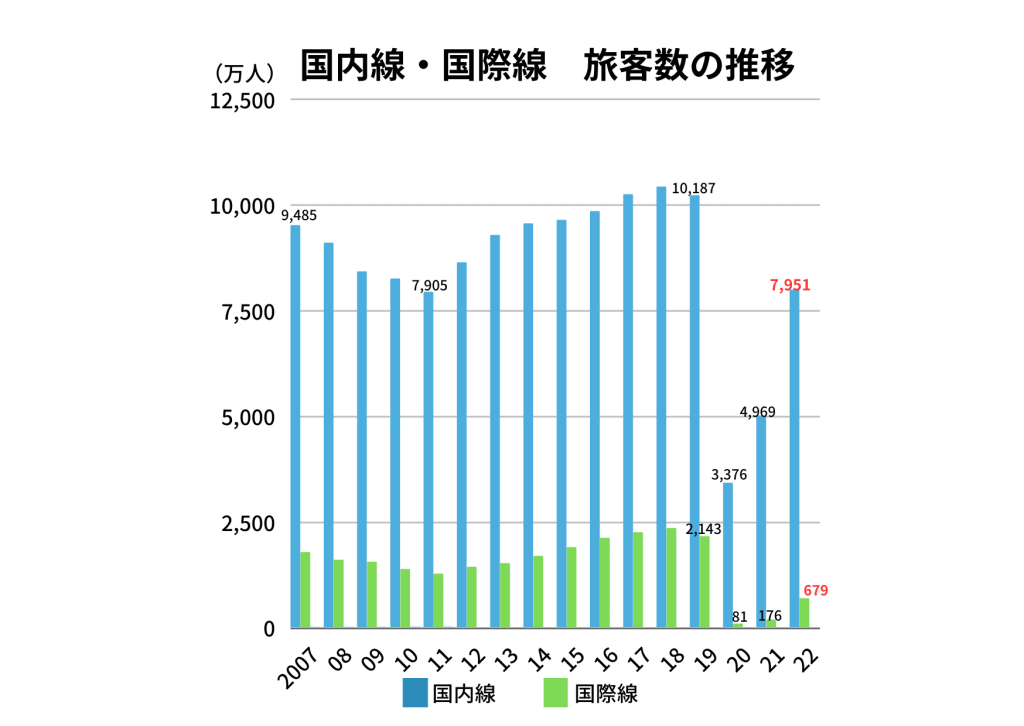

Overview of the Aviation Industry Trends in 2024

The article discusses the current state of the aviation industry in Japan, focusing on the strengths and weaknesses of major airlines, including Japan Airlines (JAL) and All Nippon Airways (ANA). It highlights the impact of the COVID-19 pandemic on passenger numbers and the subsequent recovery trends observed in 2023.

-

Types of Airlines: The aviation industry is divided into two main categories:

- Mega Carriers: These are large-scale airlines that offer a wide range of services, including in-flight entertainment and meals. Examples include JAL and ANA.

- Low-Cost Carriers (LCC): These airlines focus on providing basic services at lower prices, targeting cost-conscious travelers. Notable LCCs in Japan include Peach Aviation and Spring Japan.

-

Passenger Demand Recovery: Following the pandemic, there has been a noticeable increase in both domestic and international travel. The article notes that the demand for travel is expected to continue rising due to the easing of restrictions and promotional campaigns like "Kenmin Wari" (prefectural discounts).

-

Desired Qualities in Candidates: The aviation industry seeks individuals with strong communication skills, a sense of responsibility, and the ability to gather information and identify trends.

-

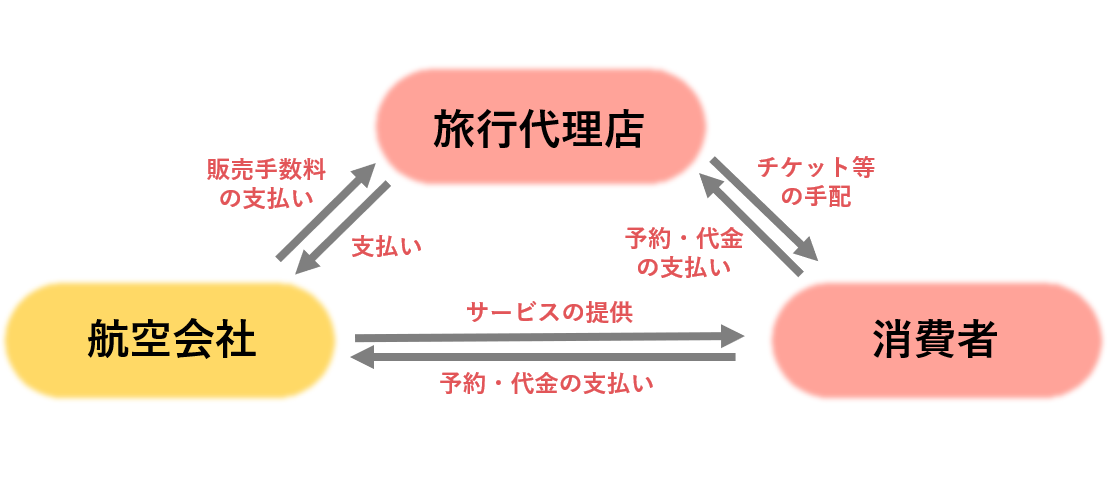

Business Models: Airlines operate through two primary business models:

- Services offered through travel agencies (e.g., package deals).

- Direct sales of tickets to consumers, reflecting a shift towards more independent travel preferences.

Job Roles in the Aviation Industry

The aviation sector encompasses a variety of roles, each requiring different skills and qualifications:

- Cabin Crew: Responsible for passenger safety and service during flights.

- Pilots: Required to have specific licenses to operate aircraft.

- Ground Staff: Handle check-in processes and customer service at airports.

- Aircraft Maintenance Engineers: Ensure the safety and functionality of aircraft.

- Dispatchers: Create flight plans based on various operational factors.

- Ground Handling Staff: Manage aircraft on the ground, including loading and unloading.

- Air Traffic Controllers: Oversee aircraft movements in the airspace and on the ground.

- Customs Officers: Manage immigration and customs processes at airports.

- Customs Officials: Inspect and regulate cargo entering and leaving the country.

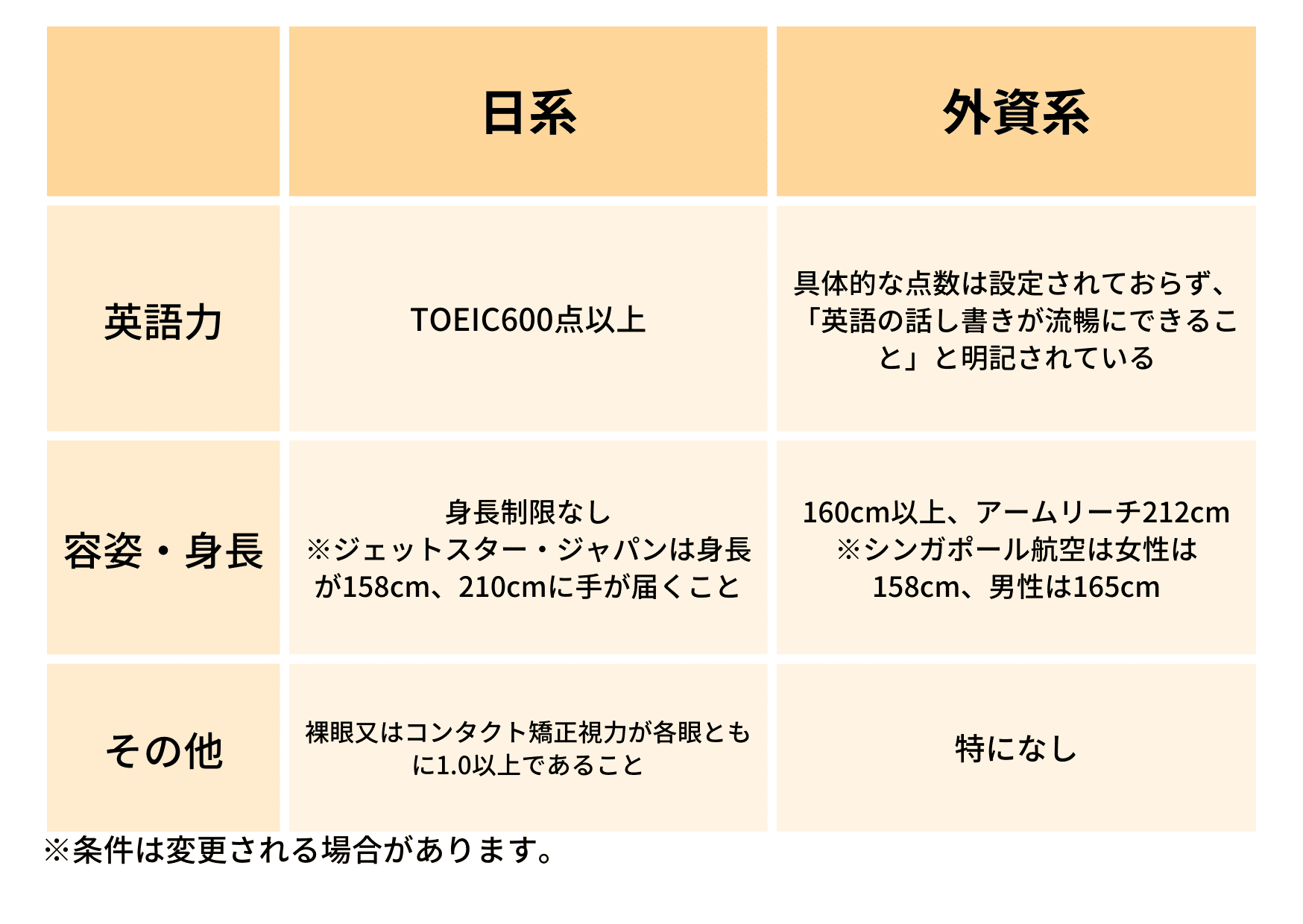

Recruitment Standards and Employment Types

The recruitment criteria and employment types differ significantly between Japanese and foreign airlines:

- Appearance and Language Skills: Foreign airlines often have stricter requirements regarding physical appearance and English proficiency compared to Japanese airlines.

- Employment Types: Japanese airlines typically hire contract employees for the first few years before transitioning them to permanent positions, while foreign airlines often employ staff on a contract basis with fewer benefits.

Current Trends in the Aviation Industry

- Recovery Strategies: Airlines are focusing on international cargo services and expanding their LCC operations to recover from losses incurred during the pandemic.

- Sustainable Practices: The industry is moving towards cleaner flights, including the use of Sustainable Aviation Fuel (SAF) and aircraft weight reduction to improve fuel efficiency.

Conclusion

The aviation industry in Japan is on a recovery path post-COVID-19, with increasing passenger numbers and a shift towards more sustainable practices. As travel demand rises, the industry is adapting to meet new consumer preferences and operational challenges. For those interested in pursuing a career in aviation, understanding these trends and the qualities sought by employers is essential for success.

For further insights into the aviation industry, you can refer to the original article here.

🏷Strengths and Weaknesses of ANA

Strengths and Weaknesses of ANA

All Nippon Airways (ANA) possesses several strengths, including a strong market presence as Japan's largest airline, a diverse service portfolio that mitigates risks, and membership in the Star Alliance, enhancing its competitive edge. Additionally, ANA is a dominant player in the domestic market with a robust brand image and extensive operational capacity, particularly at Haneda Airport. However, the airline faces notable weaknesses, such as a decline in revenue from cargo and travel services, high dependence on the domestic market, and a significant fixed asset burden that incurs ongoing costs. Furthermore, cost-cutting measures have led to a loss of employee trust and concerns about service quality, especially in international operations. The company must navigate these challenges while maintaining service quality and employee satisfaction.

Strengths of ANA

- Strong Market Presence: ANA ranks 8th globally for domestic passengers and 14th overall, with a 44.41% market share in Japan's domestic passenger services.

- Diverse Service Portfolio: The airline offers a wide range of services, including air transportation, travel services, and retail operations, which helps mitigate risks and enhance revenue.

- Star Alliance Membership: As a member of the Star Alliance, ANA benefits from a vast network of services and customer loyalty programs, improving its competitive edge.

- Operational Capacity: ANA has a significant number of slots at Haneda Airport, which enhances its operational capacity and allows it to maintain the largest domestic route network and the highest number of international flights originating from Japan.

- Employee Culture: Employees highlight a culture of motivation and a willingness to embrace new challenges, contributing to high service quality.

Weaknesses of ANA

- Revenue Decline: The airline has experienced a decrease in cargo and travel revenues, attributed to reduced demand and external factors like currency fluctuations and geopolitical events.

- High Dependence on Domestic Market: Approximately 82.3% of ANA's revenue comes from Japan, making it vulnerable to local economic conditions.

- High Fixed Asset Burden: The company has a high fixed asset burden, which leads to ongoing costs even when flights are grounded, such as maintenance and personnel expenses.

- Cost-Cutting Measures: Some cost-cutting measures have led to a loss of employee trust, and the airline is perceived to be vulnerable to external risks, particularly in international operations, where excessive cost-cutting has impacted service quality.

- Challenges in Labor Market: The airline industry is facing a decline in its status within the labor market, making it difficult to attract and retain quality staff.

For more detailed insights, you can access the full report .

swotandpestle.com

For further details, you can explore the full analysis on .

openwork.jp

🏷Market Trends and Challenges in the Airline Industry

Market Trends and Challenges in the Airline Industry

The airline industry, particularly in Japan, is currently facing significant challenges and market trends that impact major players like All Nippon Airways (ANA) and Japan Airlines (JAL). The COVID-19 pandemic has led to substantial losses, with both airlines struggling to return to pre-pandemic levels. The Japanese airline market is characterized by a duopoly, primarily dominated by ANA and JAL, which results in limited competition and high fares. Despite the entry of low-cost carriers, the market remains largely oligopolistic. In contrast, European and American markets have seen increased competition and lower fares due to the rise of low-cost carriers and deregulation. The analysis highlights the need for a more flexible fare structure in Japan, as current pricing mechanisms restrict airlines from adjusting fares based on demand. Key issues identified include limited fare variety, high base fares, and regulatory constraints. Recommendations for improvement suggest abolishing the pre-approval system for fares and encouraging more low-cost carriers to enhance competition. Overall, significant reforms are necessary to foster competition and improve fare structures in the Japanese airline industry.

Overview of ANA's Challenges

All Nippon Airways (ANA) is currently navigating significant macroeconomic and fleet challenges as it seeks to recover from the impacts of the COVID-19 pandemic. The airline anticipates a slow recovery in Japanese outbound traffic through 2024, complicated by fleet availability issues stemming from Pratt & Whitney engine problems affecting many airlines globally.

- Current Capacity and Demand:

- ANA's international capacity is at 73.8% of 2019 levels as of late November 2023.

- Passenger numbers for September 2023 were at 70.6% of the same month in 2019, indicating a solid rebound despite Japan's later recovery compared to other countries.

- The demand is skewed towards inbound travel rather than outbound, with strong load factors on routes to Hawaii exceeding 95%.

For more detailed information, you can visit the source: Centre for Aviation.

Outbound Demand Recovery

Japanese international demand recovery is lagging behind other Asian markets, primarily due to the delayed removal of travel restrictions. However, recent trends indicate improvement:

- Future Expectations:

- ANA's EVP, Shinya Kanda, suggests that outbound demand may return to normal levels by the summer of 2024.

- Initial hesitancy about overseas travel has diminished, with current concerns focused on the higher costs associated with international travel, exacerbated by a weak yen.

Performance of Hawaiian Routes

ANA has seen success in specific markets, particularly routes to Hawaii:

- High Load Factors:

- Load factors for flights from Tokyo to Honolulu reached 95.6% in July 2023, up from 91.9% in July 2019.

- The airline has fully activated its three Airbus A380s dedicated to these routes.

Impact of Pratt & Whitney Engine Issues

ANA is facing additional challenges due to the need for inspections of its Pratt & Whitney PW1100G-JM engines:

-

Flight Reductions:

- Starting January 2024, ANA will reduce its flight schedule, affecting about 30 flights daily, which represents 3.6% of its overall scheduled flights.

- Domestic flights will be more significantly impacted, with a 3.9% reduction compared to a 1.6% reduction in international flights.

-

Financial Implications:

- The airline estimates a revenue loss of JPY 8 billion (approximately USD 53.5 million) for the fiscal year ending March 31, 2024, due to these inspections and schedule cuts.

Conclusion

The current landscape for ANA highlights a shift from pandemic-related travel hesitancy to economic factors influencing demand. While strong inbound travel helps mitigate some outbound weaknesses, a more robust recovery in outbound demand is essential for ANA to expand its capacity on various routes. The grounding of the Airbus Neo fleet adds another layer of complexity to the airline's recovery efforts.

For further details, you can access the full document .

hit-u.ac.jp

Analysis of Issues in the Japanese Airline Market

The document provides a comprehensive analysis of the Japanese airline market, particularly focusing on the issues faced by major airlines such as ANA and JAL. It highlights the lack of competition in pricing among these major carriers, which maintain similar fare structures, leading to high prices for consumers.

-

Current State of the Japanese Airline Market

- The Japanese airline market is characterized by a duopoly dominated by ANA and JAL, resulting in limited competition and high fares.

- Despite the entry of low-cost carriers like Skymark Airlines, the market remains largely oligopolistic, with new entrants struggling to capture significant market share.

-

Comparison with European and American Markets

- In contrast to Japan, the European market has seen a rise in low-cost carriers such as EasyJet and Ryanair, which have significantly increased competition and reduced fares.

- The American market, while also facing challenges with major airlines filing for bankruptcy, has benefited from deregulation, leading to a more competitive environment and lower fares.

-

Airfare Analysis

- The analysis includes a detailed examination of airfares in Japan, the UK, and the US, revealing that while ordinary fares in Japan are relatively low, discount fares for leisure travel remain high compared to European counterparts.

- The document emphasizes the need for a more flexible fare structure that responds to market demand rather than being rigidly set based on distance.

-

Key Issues Identified

- Limited Fare Variety: The Japanese market offers fewer fare options compared to Europe and the US, where airlines frequently adjust prices based on demand.

- High Base Fares: The minimum fares in Japan are significantly higher than those in Europe, limiting accessibility for leisure travelers.

- Regulatory Constraints: The pre-approval system for fare changes in Japan restricts airlines from adjusting prices dynamically, unlike their European and American counterparts.

-

Recommendations for Improvement

- The report suggests that Japan should consider abolishing the pre-approval system for fares to allow airlines to set prices based on real-time demand.

- Encouraging the entry of more low-cost carriers could enhance competition and lead to lower fares for consumers.

- The government should facilitate a more competitive environment by reducing landing fees and supporting new entrants in the airline market.

This analysis underscores the need for significant reforms in the Japanese airline industry to foster competition and improve fare structures, ultimately benefiting consumers and stimulating economic activity.

For further details, you can access the full document .

hit-u.ac.jp

Industry Research: Airlines - Major Companies (All Nippon Airways (ANA) and Japan Airlines (JAL))

The airline industry has faced significant challenges due to the COVID-19 pandemic, with both ANA and JAL recording substantial losses in 2020. As of now, they have not returned to pre-pandemic levels. However, in 2022, the easing of border restrictions led to an increase in inbound foreign tourists, contributing to a recovery in leisure travel demand. Both airlines reported a return to profitability for the first time in about two years.

-

Post-COVID Recovery Efforts:

- Both airlines are focusing on strategies to return to pre-pandemic performance levels.

- Key initiatives include reducing unprofitable domestic flights, cutting the number of aircraft, and enhancing international cargo operations.

-

Key Job Roles in the Airline Industry:

- Global Staff Positions (Administrative): Involved in operational and corporate functions.

- Global Staff Positions (Technical): Responsible for maintenance and safety operations.

- Flight Operations (Pilot Training): Includes hiring experienced pilots and training new candidates.

- Cabin Crew (Flight Attendants): Focus on customer service and in-flight experience.

- Expert Staff Positions (Disability Hiring): Support core business functions and enhance service quality.

-

Performance Comparison:

- Both airlines faced significant losses in 2021, indicating the tough environment in the airline industry.

- ANA has strengthened its international cargo business to offset declining passenger demand.

Company Characteristics and Strengths

-

All Nippon Airways (ANA):

- Focuses on enhancing international cargo operations to compensate for reduced passenger traffic.

- Company culture is described as "powerful and challenging," reflecting its history as a private enterprise aiming to compete with JAL.

- Employees are characterized as dynamic and capable of thriving in diverse environments.

-

Japan Airlines (JAL):

- Known for its commitment to customer service and hospitality, embodying the spirit of "omotenashi."

- After a bankruptcy in 2010, JAL has focused on stability and maintaining a high equity ratio.

- The company emphasizes teamwork and leadership qualities among its employees.

Company Culture Differences

-

ANA:

- Values individuality and diversity, encouraging employees to express their unique qualities.

- The culture promotes a proactive approach to challenges and respects expertise across different roles.

-

JAL:

- Prioritizes cooperation and leadership that enables others to excel.

- Employees are often described as sincere and supportive, with a strong adherence to the company's philosophy.

Average Salary and Employment Statistics

| Company | Average Age (Years) | Average Salary (JPY) | Average Tenure (Years) |

|---|---|---|---|

| ANA | 45.5 | 6,910,000 | 3.5 |

| JAL | 40.8 | 8,480,000 | 15.9 |

Selection Process Insights

- Both companies require candidates to articulate their reasons for choosing a specific airline, emphasizing the importance of thorough research and understanding of each company's unique attributes.

For more detailed insights, you can refer to the full article on One Career.

Overview of JAL and ANA's Performance Forecasts Amidst Yen Depreciation and Intensifying Competition

Japan Airlines (JAL) and All Nippon Airways (ANA) have recently released their performance forecasts for the fiscal year ending March 2025, revealing divergent outlooks influenced by the post-COVID aviation landscape.

-

Market Conditions:

- There is an optimistic view regarding the rising demand for air travel.

- However, the prolonged trend of yen depreciation and intensified competition for customers pose significant challenges to profitability.

-

Performance Predictions:

- ANA Holdings (HD) anticipates a 30% decrease in consolidated net profit compared to the previous record-high year.

- In contrast, JAL projects a 5% increase in net profit, reflecting a more bullish outlook.

-

Key Factors:

- The contrasting forecasts highlight differing perspectives on the growth potential of international flights, which are crucial for both airlines.

- The competitive landscape is becoming increasingly fierce, impacting both companies' strategies and financial expectations.

For further details, you can refer to the original article on Nikkei.

🏷Strategic Initiatives for Future Growth

Strategic Initiatives for Future Growth

The ANA Group has outlined strategic initiatives aimed at future growth, focusing on recovery and expansion in the post-COVID-19 era. Key pillars include enhancing the Air Transportation Business, diversifying into non-airline profit domains, and developing the ANA Economic Zone for sustainable growth. The group targets sales of ¥2.32 trillion by FY2025, with an operating income exceeding ¥180 billion in the Air Transportation Business. Business structure reforms involve resource reduction and a transformation of the business model, leveraging customer data for profit maximization. Sustainable growth initiatives emphasize ESG management and CO2 emissions reduction. The Air Transportation strategy includes optimizing operations across its brands and increasing the fleet size to over 290 fuel-efficient aircraft. The cargo business aims to expand operations, particularly between Asia and North America, while non-airline revenues are targeted at ¥400 billion by FY2025. Digital transformation investments focus on enhancing customer experience and operational efficiency. Financial discipline is emphasized, with a goal of improving credit ratings and balance sheets. The ANA Group anticipates a gradual recovery in passenger demand and plans to launch AirJapan in February 2024 to capture growth in Southeast Asia.

Detailed Information

The ANA Group's strategic focus is encapsulated in its comprehensive corporate strategy for FY2023-25, which is designed to navigate the challenges posed by the COVID-19 pandemic and position the company for future growth. Below are the key components of this strategy:

-

Recovery and Growth Goals:

- The ANA Group aims to achieve sales of ¥2.32 trillion by FY2025, with a focus on surpassing pre-COVID profitability levels.

- The target for operating income in the Air Transportation Business is set at over ¥180 billion by FY2025.

-

Business Structure Reform:

- The group is committed to reducing resources and transforming its business model to enhance efficiency.

- There is a strong emphasis on utilizing customer data to maximize profits and expand into non-airline business domains.

-

Sustainable Growth Initiatives:

- The ANA Group prioritizes ESG management, addressing climate change, and committing to CO2 emissions reduction.

- The company aims to enhance corporate value through sustainable growth practices and digital transformation.

-

Air Transportation Business Strategy:

- Operations across the ANA, Peach, and AirJapan brands will be optimized to maximize profitability.

- The fleet size is expected to increase to over 290 aircraft by FY2025, focusing on acquiring fuel-efficient models.

-

Cargo Business Strategy:

- The group plans to expand cargo operations, particularly between Asia and North America, to meet growing demand.

- Integration of Nippon Cargo Airlines is part of the strategy to enhance operational efficiency.

-

Non-Airline Business Development:

- The ANA Group targets ¥400 billion in operating revenues from non-airline businesses by FY2025.

- New services and products, such as an upgraded ANA Mileage Club app and ANA Pay, are in development.

-

Digital Transformation:

- Significant investments in digital technologies are planned to improve customer experience and operational efficiency.

- The goal is to create a data-driven management system that enhances decision-making and service personalization.

-

Financial Strategy:

- The ANA Group emphasizes financial discipline, with an average capital expenditure of approximately ¥270 billion per fiscal year.

- The strategy includes targeting a credit rating upgrade and strengthening the balance sheet by reducing debt and increasing equity.

-

Future Outlook:

- The ANA Group anticipates a gradual recovery in passenger demand, particularly in leisure and inbound travel.

- The launch of AirJapan in February 2024 is expected to capture growth opportunities in the Southeast Asian market.

For more detailed information, please refer to the full document .

ana.co.jp

🖍 考察

Investigation Results

Based on the information provided in the context, the following key points can be summarized:

- All Nippon Airways (ANA) is the largest airline in Japan, known for its excellence in both domestic and international markets, particularly in Asia.

- ANA has adopted a multi-brand strategy to compete with low-cost carriers (LCCs), maintaining its full-service brand while also catering to budget travelers.

- ANA has received high accolades, including a 5-star rating from SKYTRAX, reflecting its commitment to quality and innovation.

- The airline's reputation is bolstered by its focus on enhancing customer experience and operational efficiency.

- ANA is navigating the challenges posed by LCCs and the evolving aviation landscape, prioritizing brand value enhancement and customer satisfaction.

Estimation

The provided context suggests that ANA is facing significant financial challenges due to the impact of the COVID-19 pandemic. Some key points regarding the estimation:

- ANA's revenue has declined substantially, from approximately 2 trillion yen pre-pandemic to around 740 billion yen in the fiscal year ending March 2022, resulting in a loss of around 100 billion yen.

- The company's stock price has halved since the onset of the pandemic, reflecting a lack of investor confidence in its future prospects.

- ANA plans to reduce its workforce from approximately 38,000 employees to about 29,000 by the end of FY2025, indicating a shift in operational strategy post-COVID.

- Compared to its rival, Japan Airlines (JAL), ANA has a higher level of debt and a lower capital ratio, posing a risk to its financial health.

- The pandemic has altered consumer behavior, with a decline in business travel due to the normalization of online meetings, impacting ANA's revenue potential.

Analysis

Based on the investigation results and estimation, the following analysis can be provided:

-

Financial Stability Concerns:

- ANA's high level of debt and declining profitability raise concerns about its long-term financial stability, especially compared to its competitor, JAL.

- The company's workforce reduction and cost-cutting measures suggest the need for a significant restructuring to address its financial challenges.

-

Adapting to Market Changes:

- The shift in consumer behavior, with a decline in business travel, requires ANA to reevaluate its service offerings and target market segments.

- The rise of low-cost carriers and the changing competitive landscape necessitate a strategic review of ANA's pricing and service strategies to remain competitive.

-

Leveraging Strengths and Addressing Weaknesses:

- ANA's strong brand reputation, innovative spirit, and diverse business ventures can be leveraged to differentiate itself in the market.

- However, the company needs to address its high fixed asset burden and cost structure to improve profitability and financial resilience.

-

Opportunities in Non-Airline Businesses:

- ANA's expansion into non-airline businesses, such as advertising and travel media, presents an opportunity to diversify its revenue streams and mitigate the risks associated with the airline industry.

- Effective utilization of customer data and digital transformation initiatives can enhance the company's competitiveness in these new business domains.

Future Investigation Themes

Based on the analysis, the following future investigation themes are recommended:

-

ANA's Debt Restructuring and Financial Optimization Strategies:

- Analyze ANA's debt management and explore options for reducing its high interest-bearing debt to improve financial stability.

- Investigate the company's cost-cutting measures and their impact on operational efficiency and service quality.

-

Competitive Positioning and Pricing Strategies:

- Conduct a comprehensive market analysis to understand the evolving competitive landscape, including the impact of low-cost carriers.

- Evaluate ANA's pricing strategies and explore opportunities for more flexible and dynamic pricing to better respond to market demands.

-

Diversification and Non-Airline Business Opportunities:

- Assess the growth potential and profitability of ANA's non-airline business ventures, such as advertising and travel media.

- Identify new business areas that can leverage the company's customer base and brand reputation to drive revenue diversification.

-

Digital Transformation and Customer Experience Enhancement:

- Analyze ANA's digital transformation initiatives and their impact on operational efficiency and customer satisfaction.

- Explore opportunities to utilize customer data and advanced analytics to personalize services and improve the overall customer experience.

-

Sustainability and Environmental Initiatives:

- Evaluate ANA's progress in implementing sustainable practices, such as the use of sustainable aviation fuel and fleet modernization.

- Investigate the company's long-term strategies to address environmental concerns and align with industry-wide sustainability goals.

By addressing these future investigation themes, a more comprehensive understanding of ANA's challenges, opportunities, and strategic direction can be obtained, enabling the development of informed recommendations to support the company's recovery and long-term growth.

このレポートが参考になりましたか?

あなたの仕事の調査業務をワンボタンでレポートにできます。

📖 レポートに利用された参考文献

検索結果: 15件追加のソース: 0件チャット: 0件

634件の参考文献から15件の情報を精査し、約75,000語の情報を整理しました。あなたは約7時間の調査時間を削減したことになります🎉

調査された文献

634件

精査された情報

15件

整理された情報量

約75,000語

削減された時間

約7時間

🏷 Overview of All Nippon Airways (ANA)

[PDF] Annual Report 2023 - ANA

In Annual Report 2023, we aim to encourage a deeper comprehensive understand- ing of the social value and economic value created by the ANA ...

全日空と日本航空の違い|企業の強みや共通する業務内容・将来性 ...

全日空と日本航空の違いを把握するために、まずは全日空の特徴から見ていきましょう。 全日空はANAの通称で知られており、日本を代表する航空会社です。

🏷 Financial Performance Analysis: 2021-2023

ANA Reports 1st Q1 Operating Profit In 4 Years - Simple Flying

International revenue was up almost three times compared to last year, while domestic revenue jumped by 40%. ANA posts profit for Q1 2023.

ANAグループの業績 | 投資をお考えの皆様へ | 株主・投資家情報

2024年3月期の業績. 過去最高益を大幅に更新。 航空業界を取り巻く環境は、ウクライナや中東地域情勢等の地政学リスクが懸念されるものの、旅客需要は回復基調が続いてい ...

ANAの企業研究|manabel 就活部 - note

まず、ANAの現状を2つの観点から読み解きます。 (a)財務状況. ANAの2022年3月期の業績としては、売上が約7400億円で約1000億の赤字となりました。

🏷 Market Comparison: ANA vs. Global Airlines

JALとANAを分析する 収益力に大きな差がついた、航空大手2社

なぜ、2社の間で差が開いているのでしょうか。売上原価率を比較しますと、JALは80.0%、ANAは83.2%。売上高が数千億円ありますから、わずか ...

【2024年最新】航空業界の動向3選!仕事内容や志望動機・自己PR ...

本記事では日本航空の事業や会社の強み・弱みなど、企業研究に役立つ情報を紹介していきます。 他にも内定を獲得するために知っておくべき”過去の選考情報 ...

🏷 Strengths and Weaknesses of ANA

All Nippon Airways (ANA) SWOT & PESTLE Analysis

Strengths. Weaknesses ; 1. Strong market presence in domestic and international services 2. Complementary Service portfolio by presence in ancillary services 3.

企業分析[強み・弱み・展望] - 全日本空輸(ANA) - OpenWork

強み: 国内において2強であること。 弱み: 固定資産が大きいため、飛行機を飛ばせなくなると、整備費用や人件費などのために利益を生まない状態でも出費が止まず一気に ...

🏷 Market Trends and Challenges in the Airline Industry

ANA faces macroeconomic and fleet challenges in next stage of ...

ANA faces the extra problem of grounded aircraft due to the Pratt & Whitney engine issues that are affecting many airlines around the world.

【業界研究:航空会社】大手2社(全日本空輸(ANA)、日本航空 ...

2020年に2社ともに大幅な赤字を記録し、現在もコロナ以前の水準には戻っていません(※1)。 とはいえ、2022年は水際対策の緩和により訪日外国人が増加したことに加え、全 ...

[PDF] 日本の航空市場の問題点の分析 ~日欧米の航空市場の比較から~

大手航空会社(ANA、JAL)については同一の運賃体系、料金を設定して. おり、大手航空会社の間では、価格面の競争は行われていない。 2、. 普通運賃は距離に応じ ...

JALとANA、円安や競争激化で視界不良 割れる業績予想 - 日本経済新聞

高まる航空需要を楽観視する半面、円安トレンドの長期化や、利用者獲得の競争の激化は業績のブレーキになり得る。 既に競争は激化している。国際航空 ...

🏷 Strategic Initiatives for Future Growth

[PDF] Business Strategy - ANA

Supported by this recovery, we expect the ANA. Group to continue to grow over the next three years, target- ing sales of ¥2.32 trillion by ...

[PDF] ANA Group Strengths

• New normal. • Change in airline market demand structure. • Reduce CO2 emissions. • Reduce resource waste ratio. • Reduce food waste ratio. • Conserve ...

📖 レポートに利用されていない参考文献

検索結果: 253件追加のソース: 0件チャット: 1件

[PDF] ANA HOLDINGS INC.

◎ In the first year of our ANA Group Corporate Strategy, fiscal 2023 results exceeded our initial plan significantly in terms of financial ...

ANA's Record Profits Amidst Travel Resurgence

With operating revenue surging by 20% year-on-year to Y2.1 trillion ($13.26 billion), ANA achieved a remarkable operating income of Y208 ...

A look at flight data trends and the On-Time Performance leaders in ...

Overall, when comparing flight activity in January 2024 to the same month in 2019, global flight activity reached 87.1% of the pre-pandemic ...

[PDF] ANA: the Most On-Time Airline in the World - Cirium

ANA benchmarks its key operational metrics including on-time performance with intelligence derived from Cirium's aviation analytics. Cirium's real-time data ...

Targets and Status of Specific Activities - ANA

The ANA Group aims to grow into a world-class airline by becoming one of the leading corporate groups in Asia, a market packed with competitors recognized ...

Investment Research Analysis Risk Management Ana Airline

Investment Research Analysis Risk Management Ana Airline ; Efficiency: Return on Assets. -2.12%, -5.69%, -0.88%, 1.86% ; Capitalization: Debt/Equity, 207.52 ...

ANA: Vision of customer satisfaction and value creation

In the nine months ended December 31, ANA's financial trends were better than JAL's, reflecting successful cost controls but also slightly better revenue ...

[PDF] Financial Results for the Three Months ended June 30, 2023 - ANA

→ Significant top-line growth year on year. 2.7 times. (+¥105.1 Bn). Record-high for the 1Q. +40%. (+¥40.4 Bn). -60%. (-¥56.5 Bn). +78%. (+ ...

ANA HOLDINGS - Financial Results for three months ended June 30 ...

Airline competition: A comprehensive review of recent research ...

ANA HOLDINGS Announces Mid-Term Corporate Strategy for FY2023-2025 ...

スライド 1

An Analysis of the Competitive Actions of Boeing and Airbus in the ...

Mideast Goes Low Cost - Airline Weekly

[PDF] ANA HOLDINGS INC.

Comparison of Financial Results for FY2023 and FY2022. 16. 【4Q[Jan ... Air. Transportation. Non-Airline. Business. Earning. Forecast. Highlights.

Annual Report 2022

ANA Group's Financial Highlights - Investor Relations

Against this backdrop the ANA Group's operating revenues increased from the previous year reaching ¥2,055.9 billion (up 20.4% year-on-year). Operating income ...

Strong international travel demand propels ANA parent to record ...

ANA Holdings significantly improved its nine-month profits despite ongoing geopolitical uncertainty, as international travel demand ...

ANA HOLDINGS Financial Results for the Three Months Ended ...

for the Three Months Ended June 30, 2024. Passenger and cargo demand continued to recover, and sales revenue reached 516.7 billion yen, setting ...

[PDF] Financial Results for the Year ended March 31, 2023 - ANA

Resumed international flights for select routes, ... Comparison of Financial ... -Mar.) 3.ANA Domestic Passenger. Air. Transportation. Non-Airline.

ANA : Financial Results for the Three Months Ended June 30, 2023

In the first quarter, both operating revenue and operating income increased significantly compared to the same period the prior year, resulting ...

ANA HOLDINGS Financial Results for the Three Months Ended June 30 ...

The Monthly On-Time Performance Report – December 2023 – Cirium

All Nippon Airways Earns Record $1.3 Billion Profit in FY2023

[PDF] Economic Performance of the Airline Industry - IATA

Airline financial performance is expected to recover in all regions in 2022. North America is expected to turn to profitability in 2022.

ANA was awarded the most on-time airline in the Asia Pacific ...

ANA-branded flights(*3) recorded an 82.75% on-time performance(*4) and was named the top performer in the Asia Pacific region.

The Monthly On-Time Performance Report – August 2024 - Cirium

The month of August saw a decrease in the number of regional flight cancellations and improvement in the overall performance of airports and airlines.

Airline On-Time Tables - Bureau of Transportation Statistics

These tables created by the Bureau of Transportation Statistics (BTS) summarize and provide historical comparisons of monthly on-time reports filed by large ...

ANA Achieves 11 Consecutive Years of 5-Star Excellence from ...

ANA is the only Japanese airline to maintain the 5-Star rating for 11 consecutive years since 2013, a testament to its unwavering commitment, dedication and ...

World's Top 100 Airlines 2024 | SKYTRAX - World Airline Awards

View the World's 100 Best Airlines 2024 as rated by air travelers in the global airline passenger satisfaction survey.

Avianca, MSP Tops in 2023 On-Time Performance | Business Travel News

World's most on-time airlines and airports in 2019 - Wings ...

SolvedbyCirium – ANA – Cirium

JAL vs ANA: comparing the Japanese airlines | Flightradar24 Blog

ANA Round the World Award -- Best Way to Explore the World

Ranked: The World's Largest Airlines by Passengers Carried

In-depth SWOT Analysis of Airline Industry - 2024 - IIDE

Looking for the SWOT Analysis of Airline Industry? We got you, in this blog we have covered the strengths, weaknesses, opportunities and threats.

Airlines Market Size, Share Analysis: Projections of Share, Trends ...

Through a comprehensive SWOT analysis, we highlight the strengths, weaknesses, opportunities, and threats faced by these market players.

SWOT Analysis of Airline Industry - Studybay

Weaknesses · 1. Unavailable International Travel · 2. Failed Diversification of Revenue Sources · 3. Dependence on One Aircraft.

SWOT Analysis of the Airline Industry - Top Essay Writing Service ✒️

The major weakness in the airline industry is that the earnings are correlated with fuel prices. Therefore, the largest expense in this sector ...

Analysis: Are global airlines cooking their books? - Transparently.AI

Analysis indicates many airlines may be manipulating their accounting. Learn about airlines' challenges and why they have high manipulation ...

Aviation Market Analysis - Size and Forecast 2024-2028 - Technavio

Aviation Market size is estimated to grow by USD 636.7 billion from 2024 to 2028 at a CAGR of 8% with the commercial aviation having largest market share.

Airlines Global Market Report 2024

The airlines market size has grown strongly in recent years. It will grow from $523.04 billion in 2023 to $566.06 billion in 2024 at a compound annual growth ...

SWOT Analysis of The Airline Industry

A high spoilage rate acts as a big weakness of the airline industry. The spoilage rate shows how often passengers miss their pre-booked flights.

What are the Strengths, Weaknesses, Opportunities and Threats of American Airlines Group Inc. (AAL)? SWOT Analysis

Southwest Airlines SWOT Analysis: 51 Factors Affecting its Flight ...

Sample SWOT for an Airline -

Southwest Airlines SWOT Analysis (2024)

Global Aviation Industry Report Competitive Landscape In The ...

SWOT Analysis of American Airlines (Updated 2024) | Marketing91

Firm value in the airline industry: perspectives on the impact of ...

Southwest Airlines SWOT 2024 | SWOT Analysis of Southwest Airlines ...

American Airlines SWOT Analysis - The Strategy Story

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business.

Important Issues for the ANA Group's Growth Strategy (Materiality)

The ANA Group has targeted becoming the world's leading airline group. We believe that we should be a corporate citizen that develops in tandem with society by ...

Global Airlines Industry - Trends and Opportunities - GoodFirms

Soaring fuel prices, debt, and interest expenses also remain the three most challenging issues the aviation industry is dealing with in the aftermath of the ...

[PDF] Airline Cost Performance - IATA

The analysis allows comparisons to be made between airlines in the same region but, due to large differences in cost structures and stage lengths, should not be ...

Global Low Cost Airlines Market Challenges Ahead | 2031 - LinkedIn

The Low Cost Airlines market is projected to exhibit robust growth from 2024 to 2031, with a steady compound annual growth rate (CAGR) of ...

Airline efficiency and environmental impacts – Data envelopment ...

This study developed a two-phase, two-stage model using a data envelopment analysis (DEA) approach to simultaneously evaluate airline operations.

What are the Strengths, Weaknesses, Opportunities and Threats of Hawaiian Holdings, Inc. (HA)? SWOT Analysis

Aircraft Seating Market Size, Share, Trends & Growth Drivers

ANA HOLDINGS Financial Results for the Year Ended March 31, 2024

For the current fiscal year, ANA HOLDINGS INC. is forecasting an operating income of 170.0 billion yen, surpassing the highest record before ...

Which airline is better, ANA or JAL? - Quora

Moreover they continue to have nonstop maintenance problems, issues. ANA is rated slightly higher than JAl, they are both in the top ten of ...

I flew United after flying on 2 of the world's best airlines earlier ...

Flew United Economy and It Was Disappointing Compared to Singapore, ANA Airlines - Business Insider.

Some "ANA" flights are now operated by "Air Japan", impact ...

ANA has confusingly created a LCC called Air Japan, which it owns. When booking ANA flights, including through United with an ANA (NH) code ...

ANA Flight vs other airlines : r/JapanTravel - Reddit

Personally, I'd take the ANA flight. The food and service is just better. Also, this is YMMV, but on my last flight to Japan (IAD - NRT with ANA) ...

ANA Group's History Turning Point ~Our Journey into the Skies

While ANA's international business grew rapidly since 2000, we encountered new challenges. Due to the 9/11 terrorist attacks in the US in 2001, the Iraq War in ...

An Overview of ANA Award Bookings : r/awardtravel - Reddit

First, there are multiple ways to book ANA flights to Japan - directly via ANA or through partner airlines such as Virgin Atlantic (VS), Air ...

World's Best Business Class: ANA Or Qatar Airways?

There can only be one. Here's a head to head battle for world's best business class between the Qatar Airways Qsuite and ANA's 'The Room'.

[PDF] Rising to the Challenges - AnnualReports.com

As a result of the trust it has earned, ANA has had the good fortune to grow into a world-class airline, with more than 45 million passengers a year. The ANA ...

A new deep dive into passenger frustration with airlines - TNMT

Ana All Nippon Airways vs Japan Airlines comparison 2022! Vs

ANA all nippon airways Vs Vistara Airlines Comparison 2024! Vs

The Airline With Flying Turtles: ANA's Fleet In 2022

Ana vs Japan Airlines: The Ultimate Guide for Travelers - Greater ...

Singapore Airlines Vs ANA All Nippon Airways Comparison 2022! Vs

スライド 1

航空業界の業界研究|市場規模や今後の動向・仕組みや職種 ...

本記事は航空業界に関する業界研究を進める就活生向けに、航空業界の仕組みや業態、市場規模や現状、今後の動向について詳しく解説しています。

[PDF] 2023~2025年度 中期経営戦略 - ANA

また、弊社が事業活動を行っている市場は状況変化が激しく、技術、需要、価格、経済環境の動向、外国為替レートの変動、. 感染症の継続・拡大、その他多く ...

[PDF] 航空を取り巻く状況と今後の課題・取組 - 国土交通省

2021年度の旅客収入は前年と比べて増加傾向にあるものの、依然としてコロナ禍の影響を大き. く受け、需要は低調に推移している。 このような環境の中、 ...

ANAとJAL、「航空チケット値上げ」で決算に異変 - 東洋経済オンライン

経営破綻以降、収益性を重視する経営方針を取ってきた日本航空(JAL)に対し、ANAホールディングス(HD)は国際線を拡充し、売上高を積極的に伸ばしてきた。

航空業界の今後は?コロナ後の回復戦略と課題を解説!

JALとANAは、コロナ禍による航空需要の低迷に対し、それぞれ異なる方法で人員を最適化しました。 JALは、約3,000人の従業員を新しい分野に配置転換しま ...

[PDF] 今後の航空需要の見通しと 日本の航空機産業への期待

コロナ禍の2020~21年度は2期連続で赤字となり、累積赤字は△約5,400億円に拡大。 ✈ 2022年度は需要回復による売上高増加とコストマネジメントの徹底 ...

JALの2023年度決算について(ANA対比) - 航空経営研究所

JALの2023年度決算について(ANA対比). 営業利益1409億円. 2024年度見通しは増益の1700億円. ANAとはほぼ同傾向ながら、傾向に差があるところも。

統合報告書 2022

コロナ禍でも“継続”成長した「あの航空会社」、ライバルはバス ...

ANA、売上高大幅増で過去最高の営業利益、国際線旅客収入が過去最高 ...

旅行需要“爆増”の航空業界、国際線が前年比3倍でも「まだ安心できない ...

会社はもつのか」 ANA・JAL、窮地脱却へ奔走 試練の航空(1) - 日本経済新聞

スライド 1

スライド 1

[PDF] 事業戦略 - ANA

航空事業では、ANA・Peach・AirJapanの3ブランドの最適. 化を図る一方、ANAは貨物事業を拡大して、利益を最大化. します。 ノンエア事業では、事業分類に応じた最適な ...

[PDF] ワクワクで 満たされる 世界を - ANA

本報告書では、受け継がれてきた理念と価値創造の全体像を. 示すとともに、危機克服と成長回帰に向けた事業戦略や中長期的なサステナビリティ. の取り組み ...

【大手航空会社比較】ANA・JALの違いとは-強み・社風・平均年収 ...

大手航空会社であるANA(全日本空輸)とJAL(日本航空)の強み・社風・平均年収・職種別の選考フローの違いを比較しています。

航空業界の現状と今後の見通しは?特徴・職種・仕事内容・就職 ...

航空業界に興味がある学生に向けて、航空業界の特徴や現状、課題と今後の見通しについて解説しています。航空業界のおもな職種と仕事内容、就職が向い ...

[PDF] 2023年3月期決算 - ANA

弊社グループの主要事業である航空事業には、空港使用料、航空機燃料税等、弊社の経営努力では管理不可能な公的負担コストが. 伴います。また、弊社が事業 ...

JAL・ANAよりもLCC?本当に航空業界に行きたいなら ... - Unistyle

就活生の人気企業として毎年ランクインするJAL・ANA。一方、同じ航空業界であってもLCCを選択肢に入れている就活生は少ないように思われます。

ANAとJALで学ぶ、はじめての企業分析|アキ

最新2024年】ANAのマーケティング戦略について【全日空 ...

[PDF] 航空業界における差別化戦略

他社と比較す. るならば,JAL や ANA(全日本空輸 ... 逆に,航空会社において. も,搭乗率アップに向けた取り組みなどは重要. な課題であり,地方都市と航空会社は共存関係.

【ANAとJALの特徴と違い】就活で求められるものも紹介

ANAとJALが二台巨頭であるため、航空業界を目指すのであれば志望する人が多いですが、問題はどちらに就職するのかということです。 選考の段階では両方を ...

[PDF] 事業戦略 - ANA

本パートではこれらの課題に対応するために、2020年10. 月27日に策定した「事業構造改革」と、2021年度計画の概要. についてご説明します。 新型コロナウイルス感染症の ...

#SolvedbyCirium – ANA | Cirium (シリウム)

航空会社は、当社が収集した各データセットを活用することで、社内や、競合他社との比較のため、ベンチマークの作成やモニタリング、パフォーマンスの改善の分析が可能に ...

企業研究】航空会社全日空(ANA)と日本航空(JAL)の違い|グローバル ...

日本航空(JAL):3分対策】ANAと比較!書類・動画・面接はリーダー性 ...

ANAとJALって何が違うの?就活に役立つ企業比較のポイント · en-courage

2024年最新】ANAのブランド戦略|マーケティング研究家@よんばん

航空業界の動向や現状、ランキング等を解説

航空業界の動向や現状、ランキング&シェアなどを研究しています。データは2022-2023年。航空業界の過去の市場規模の推移をはじめ、国内線や国際線の ...

スカイマーク、「規模20倍」のANA・JALに勝てる領域拡大へ

航空業界には2強のANA・JAL、3位守るスカイマーク · 価格やサービス、2強とLCCの中間のポジションを取る · 人材育成に注力し「勝てる領域」を地道に広げる ...

[PDF] 航空を取り巻く社会情勢等について(補足資料) - 国土交通省

総体的に見て航空業界は利益率の高くない業界であることが分かる。 登録航空会社 営業収 と営業利益率と 関係(. 年). 営業利益率.

エアライン・航空業界の世界市場シェアの分析 | deallab

財務を徹底分析、ANA・JALはコロナ禍でどこまで追い込まれていたのか ...

ANAホールディングス】閑散期の赤字を解消しJALを猛烈に追い上げ ...

スカイマーク、再上場決定も見えない成長戦略 ANAが株主としての影響力 ...

Press Release

American Nurses Foundation Financial Information | ANA

Download Previous Audited Financial Statements · 2022 Audited Financial Statement (shared). pdf (0.49MB) · 2021 Audited Financial Statement (shared). pdf (0.69MB).

ANA Holdings Inc. (ALNPY) Income Statement - Yahoo Finance

Get the detailed quarterly/annual income statement for ANA Holdings Inc. (ALNPY). Find out the revenue, expenses and profit or loss over the last fiscal year ...

ANA HOLDINGS Financial Results for the Six Months Ended September ...

Financial Results | Investor Relations | ANA HOLDINGS INC. - ANA

Financial Results · Presentations · Filings · Monthly Traffic Results · Annual Report · Ordinary General Meeting of Shareholders · Historical Data xls.

9202.JP | ANA Holdings Inc. Financial Statements - WSJ

ANA Holdings Inc. balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View 9202.JP financial statements in full.

[PDF] Financial Statements for the year Ended March 31, 2023

The Company principally applies the following useful lives: Buildings and leasehold improvements. 3 – 60 years. Vehicles. 6 years. Tools, furniture and fixtures.

ANA Financial Results, Record Profits of 210 Billion Yen

Impressive ANA Financial Results · Achieved a record historical high operating income of 210.1 billion yen. · Revenue increases by 284.9 billion ...

ANA HD posts nine-months financial results - AviTrader

ANA HOLDINGS (ANA HD) has reported its financial results for the nine months ended December 31, 2023.

ANA Holdings First Quarter 2025 Earnings: EPS Misses Expectations ...

ANA HOLDINGS Financial Results for the Nine Months Ended December ...

Presentation Transcript

International travel demand drives ANA revenues and operating profits

Mainline carrier ANA's international passenger revenue jumped 68% to Y728 billion, as the number of international passengers carried rose 69.4% ...

Wow: ANA Reports 90% Year-On-Year Rise In International ...

Between April and December 2023, the airline increased international passenger numbers by close to 90% compared to the same nine months in 2022.

ANA Holdings (All Nippon Airways) - World Benchmarking Alliance

In 2020 its revenue was USD 9.56 billion. ANA is the largest airline in Japan by revenue and passenger numbers. It controls several subsidiary passenger ...

[PDF] Financial Results for the Nine Months ended December 31, 2023

This material contains forward-looking statements based on ANA HOLDINGS INC.'s current plans, estimates, strategies, assumptions and beliefs.

Chart: The Asian Airlines With the Highest Revenues in 2022 | Statista

Financial Statistics | Financial Highlights | Investor Relations ...

Airline Quarterly Financial Review | US Department of Transportation

The reports below contain tables and charts on the financial condition of the U.S. Major and Passenger National airlines.

Performance evaluation of the global airline industry under the ...

This study assesses the efficiency of 26 international airlines from 2019 to 2022 using a dynamic network data envelopment analysis (DNDEA) methodology.

Japan's JAL and ANA see Q1 revenue growth but profits drop

ANA reported the highest revenue for the April-June quarter, with a 12% year-on-year increase to 516.7 billion yen. Net profit decreased by 19% ...

American Airlines Reports Fourth-Quarter and Full-Year 2021 ...

The Rise of Ancillaries in the Aviation Industry | Future of ...

Commercial Aviation Global Growth Analysis until 2043 | Grupo One Air

ANA Group's Growth Strategy | Investor Relations - ANA

The ANA Group will aim to become a truly tough airline group which is resistance to any environmental changes and build a foundation for group management.

Airlines Market | Staying Up to Date with New Growth Plans for 2032

The global Airlines market size was valued at USD 1029917.35 million in 2022 and is expected to expand at a CAGR of 5.97% during the forecast period.

[PDF] Analysis of the ANA Group Corporate Strategy by President and

I would like to begin with an explanation of the strategic progress we have made so that readers understand the current status of the ANA Group.

Analysis of the ANA Group Corporate Strategy by President and ...

Our theme was renaissance as a competitive ANA Group, and our three pivot points were Group Reorganization, Multi-Brand Strategy and Cost Restructuring.

Global Commercial Airlines Market 2020-2024: Market Analysis ...

Swot Analysis Strengths Of An Airline Company Strategies Overcome ...

Worldwide Airlines Industry Share, Market Growth & Trends ...

All Nippon Airways SWOT Analysis - Key Strengths & Weaknesses

Here is a detailed SWOT analysis of All Nippon Airways covering strengths, weaknesses, opportunities and threats.

All Nippon Airways SWOT: a secure base with room for improvement ...

Strengths: Size, nuances of Japan's market · Weaknesses: High cost, muddled LCC strategy, low international experience · Opportunities: growth in ...

All Nippon Airways SWOT Analysis.docx - Course Hero

However, All Nippon Airways suffers from low utilization of their aircraft and 60% domestic load factors which makes them inefficient to a degree. This can ...

Ana Holdings Inc SWOT Analysis - GlobalData

Ana Holdings Inc SWOT analysis - complete, up-to-date information on Ana Holdings Inc's strengths, weaknesses, opportunities and threats.

ANA Finds Weakness in Strength - Bloomberg

ANA Holdings, whose passenger traffic is about 25 percent greater than Japan Airlines,1470207140687 spends about a fifth of its operating costs ...

Swot Analysis Weaknesses Of An Airline Company Strategies Overcome ...

SWOT Analysis of the Airline Industry | Creately

American Airlines SWOT Analysis [Free Download]

Airline industry outlook | J.P. Morgan Research

Indeed, capacity for short-haul, intra-Europe flights is expected to increase by 6.9% in the third quarter of 2024 (excluding data from Russia, ...

Flights - Worldwide | Statista Market Forecast

The Flights market worldwide is projected to grow by 4.43% (2024-2029) resulting in a market volume of US$0.77tn in 2029.

Global Airlines - Market Research Report (2013-2028) - IBISWorld

Overall, industry revenue is estimated to decrease an annualized 3.8% to $762.8 billion over the five years to 2023, despite an expected expansion of 5.3% in ...

Global airline industry set for record growth in 2024 - AviTrader

IBA predicts that global airline capacity will grow 9.2% from 2023 to 2024. Operators will continue to increase their capacity for the rest of ...

Airlines Market Size, Share & Trends Analysis Report by 2030

The Global Airlines Market is valued at USD 553.9 Billion in 2022 and is projected to reach a value of USD 735 Billion by 2030 at a CAGR (Compound Annual ...

Aviation - Statista

In 2023, the estimated global market size of the global airline industry was 762.8 billion U.S. dollars. This was considerably higher than the values ...

Aviation Market Share Industry Growth Overview - Mordor Intelligence

The Aviation Market is expected to reach USD 333.96 billion in 2024 and grow at a CAGR of 2.87% to reach USD 396.15 billion by 2029.

[PDF] Global Outlook for Air Transport Deep Change - IATA

Most regions are expected to climb above 2019 levels in. 2024, and most countries will experience continuous growth. (Chart 11). Connectivity to ...

Global Airlines Market Size, Demand, Outlook - 2033

Global Airlines Market Overview 2024: Size, Drivers, And Trends ...

on the fly: How have global airline capacity trends really been ...

Airline Industry Market Size, Share | CAGR of 6.3%

Global Aviation Analytics Market - Global Industry Analysis and ...

Aviation Analytics Market Size, Share, Growth Drivers, Trends ...

Aviation Analytics Market: Global Industry Trends, Share, Size ...

Global Commercial Airlines Market 2020-2024 | Evolving ...

[PDF] FY2023-2025 ANA Group Corporate Strategy

The formulation is based on ANA Group business plan, the necessary airline capacity for 60 million inbound tourists as Japanese Government's ...

[PDF] Business Strategy - ANA

The management environment surrounding the airline industry has changed dramatically due to the impact of COVID-19. The sharp decline in ...

Airline Profitability Outlook Improves for 2024 - IATA

IATA announced strengthened profitability projections for airlines in 2024 compared with its June and December 2023 forecasts.

American's Revenue Performance Sinks - Cranky Flier

American's poor revenue performance in the quarter. My initial thought was that American's efforts to abandon its sales efforts have left a mark, but the ...

Grounded Growth: The decline of new airline foundings - TNMT

AI Redefining the Commercial Airlines Market, USD 370.2 Billion ...

Japan's ANA Turns First Post-Pandemic Annual Profit - Airline Weekly

ANA recovered to nearly 68 percent of its pre-pandemic international capacity in the March quarter. Traffic recovered to 65 percent of 2019 ...

2024] Southwest Airlines SWOT Analysis - Fresh Example

[PDF] all nippon airways (ana) swot & pestle analysis - S&P TEST

The company offers air and cargo transportation, travel, ground handling and trading services through various subsidiaries. The company operates in air.

All Nippon Airways SWOT: ANA poised for big things | CAPA

ANA needs to defend against future competition from low-cost carriers and emerging airlines in China. STRENGTHS: Efficient and responsive to ...

(PDF) A SWOT Analysis of General Aviation Industry Development ...

A SWOT analysis (Table 2) is therefore used not only to identify the company's context but also in the risk identification process.

SWOT analysis of aviation logistics industry | Download Scientific ...

SWOT Analysis of the Airline Industry | Creately

SWOT Analysis in Airline Industry

ANA Receives Top Score in Both Global and Asia Pacific Categories ...

The World's Top 10 Airlines of 2024 | SKYTRAX

Check the world's Top 10 Airlines 2024 as rated by travelers in the global airline passenger satisfaction survey. View Top 10 Airline Ratings 2024.

ANA was awarded the most on-time airline in the Asia Pacific ...

In the ranking for airlines based in the Asia-Pacific region (excluding the United States)*2, ANA-branded flights*3 recorded an 82.75% on-time performance*4 and ...

ANA flies high in on-time global airline report; industry faces ...

All Nippon Airways demonstrated its experience winning the top Global Network Airline award for with an "on time performance" of 89.79% on ...

The Monthly On-Time Performance Report – October 2021: Rough ...

These were the most on-time airlines in January

Japan's airlines, Haneda slide in on-time performance ranking ...

ANAホールディングスの業績推移 - ANAHD中間決算、3年ぶり黒字に ...

財務・業績ハイライト | 株主・投資家情報 | ANAグループ企業情報

売上高、営業利益、当期純利益、ROE、ROA等の連結業績情報や経営指標をご覧いただけます。 ... 過去5年分のキャッシュフロー情報をご覧いただけます。 配当・1株当たり情報.

2024年3月期決算について - ANA Group 企業情報

2024年3月期決算について · ・売上高が2兆559億円となり、営業利益は2,079億円で過去最高益を大幅に更新し、営業利益率は初めて10%を超えました。 · ・国際 ...

【ANAホールディングス】[9202]決算発表や業務・財務情報 | 日経 ...

【日本経済新聞】ANAホールディングス[9202]の配当・売上高・営業利益など決算情報を収録。中間業績や貸借対照表、キャッシュフローの状況やセグメント情報も掲載。

9202 ANA HD | 会社業績

9202 ANA HD 売上高 営業利益 1/3 2008年3 ... 業績推移. 売上高#2. 2008年3月(連): 1兆4878億; 2009年3月(連) -6.4%: 1兆3925億; 2010年3月(連) -11.79%: 1兆2283億 ...

ANAホールディングスが業績予想の上方修正を発表!2024年3月期 ...

ANAホールディングスが業績予想の上方修正を発表!2024年3月期の営業利益を前回予想比35%増に修正、売上高は前回予想比3%増で、3期連続の「増収増益」に.

決算ハイライト | 株主・投資家情報 | ANAグループ企業情報 - ANA

資産の部は、有価証券が増加したこと等により、前期末に比べて588億円増加し、3兆6,283億円となりました。 負債の部は、航空券の予約発券数の拡大に伴う契約負債が増加した ...

2025年3月期 第1四半期決算について - ANA Group 企業情報

・旅客・貨物ともに需要回復が続き、売上高は5,167億円となり、第1四半期として過去最高を更新しました。 · ・特に、国際旅客の売上高は、旺盛な訪日需要や ...

ANAホールディングス(9202) 決算 - 株探(かぶたん)

ANAホールディングス(ANAHD)【9202】の業績分析ができる多様な決算情報を掲載。決算発表と業績修正はリアルタイムで更新。通期は5期、半期は4半期、四半期累計は3期、 ...

ANAホールディングス ことし3月までの決算 最終利益が過去最高

航空大手、ANAホールディングスのことし3月までの1年間の決算は国際線が好調だったことなどから、最終的な利益が、1570億円と過去最高となりました。

職人が作る業績グラフ - 【ANAホールディングス】3か月業績推移グラフ ...

ANA(全日空)の売上高と純利益の推移のグラフ | グラフストック ...

業績回復が鮮明な「ANA」と「JAL」成長速度に違いが生じる要因は ...

[PDF] 成長戦略における 重要課題(マテリアリティ) - ANA

境の変化や社会動向から、ANA. グループの強み・弱み、経営資源. に影響を与える課題やボトル. ネックを明らかにすることで、中. 期経営戦略策定に向けた仮説. を立てまし ...

重要課題の特定 | サステナビリティ | ANAグループ企業情報

ANA増益・JAL黒字化…航空2社決算、国際線の回復が業績けん引

航空大手2社の2023年4―9月期連結決算が31日出そろい、両社ともに増収、大幅に利益が回復した。ANAホールディングス(HD)は営業利益が前年同期比4・1倍 ...

JALの2022年度決算解析とANAとの比較Ⅱ(財務の部) - 航空経営 ...

ANAは機材削減&小型化進行、JALは大型機を新鋭機に更新。 JALは資金の純流出が多く、財務体質が悪化。 (追記)参考としてコロナ前の両社の事業戦略背景を追記(筆者見解).

JAL・ANAの復調鮮明、需要回復追い風 単価上昇も寄与 - 日本経済新聞

ANAHDの23年4〜12月期の連結営業利益は前年同期比2.1倍の2101億円と過去最高だった。 好調な業績を踏まえ、24年3月期通期は前期比58%増の1900億円を見込 ...

ANA、純利益19.5%減247億円 売上高は過去最高更新=24年4-6月期

4-6月期の売上高は12.1%増の5167億7500万円、営業利益は30.7%減の303億5400万円、経常利益は14.9%減のの368億2200万円で、売上高は第1四半期として過去 ...

JALが「稲盛イズム」と決別?ANAを再逆転へ、破綻以来の“禁じ手”解禁 ...

JALの2022年度決算解析とANAとの比較Ⅰ(収支の部) - 航空経営研究所

ANAとJAL コロナ前からどう変わった?Q3決算(その2)収益性比較 ...

ANAが「不公平」と訴えるJALとの財務格差、その原因は“あの事件 ...

企業分析:ANA・JAL 国内航空2社比較 22年3月期決算より ~黒字化への ...

2019年度版】ANAホールディングスとJAL(日本航空)の図解・財務分析

事業報告|ANAホールディングス株式会社 スマート招集

ANAとJALの就職人気が回復した航空業界、課題は人手不足とSAF ...

航空業界が直面している課題のひとつは、空港の人手不足です。航空機の誘導やカウンターでの受付などの空港業務を<グランドハンドリング(グラハン)といい ...

[PDF] 重要課題・ 価値創造を支える土台 - ANA

環境への取り組みと、社会的責任を重視する企業姿勢が高く評価され、ANAは2008年に. 環境大臣から運輸業界・航空業界として第一号の「エコ・ファースト企業」に認定 ...

[PDF] 創業の理念に立ち返り、 グループ一丸となって コロナ禍を乗り越え ...

世界共通の課題である気候変動への取. り組みは、これからの時代を担う企業に課せられた責務で. あり、航空業界に対しても航空機の運航によるCO2排出量. の削減を求める ...

9202 ANA HD | 対処すべき課題 - IR BANK

(3) 対処すべき課題「2023~2025年度 ANAグループ中期経営戦略」の期間を「2030年に目指す姿の実現に向けた変革」を進める3年間と位置付けており、コロナ禍 ...

[PDF] 事業等のリスク - ANA Group 企業情報