📜 要約

### Summary of Purpose and Objectives

This investigation focuses on analyzing the recent financial performance of All Nippon Airways (ANA), Japan's leading airline, and comparing it to its key competitors, particularly Japan Airlines (JAL). The report aims to provide a comprehensive overview of ANA's strengths, weaknesses, market trends, and challenges, with the goal of informing strategic decision-making and identifying opportunities for growth and improvement.

### Key Findings and Insights

- ANA has faced significant financial challenges due to the COVID-19 pandemic, reporting losses of around 100 billion yen in the fiscal year ending March 2022, the second consecutive year of losses.

- The pandemic has led to a sharp decline in ANA's stock price, reflecting decreased investor confidence, and the company plans to reduce its workforce by around 9,000 employees by 2025.

- However, ANA has experienced a strong recovery in both domestic and international travel in the past year, with international passenger traffic increasing by 2.4 times in the first quarter of fiscal year 2023.

- Comparative analysis reveals that JAL has outperformed ANA in terms of profitability and operational efficiency, with a lower cost of sales ratio and improved financial health following its post-bankruptcy restructuring.

- Both ANA and JAL face challenges in adapting their strategies to the evolving market, particularly in light of limited fare variety and high base fares in the Japanese aviation industry compared to international markets.

- ANA is also grappling with operational challenges, such as Pratt & Whitney engine issues, which are expected to result in a revenue loss of JPY 8 billion for the fiscal year ending March 31, 2024.

### Summary of Results and Conclusions

The investigation of ANA's performance and competitive landscape highlights the airline's efforts to recover from the COVID-19 pandemic and adapt to changing market dynamics. While ANA has experienced a positive trend in its recovery, it continues to face financial and operational challenges that require strategic adjustments. The comparative analysis with JAL suggests the need for both airlines to enhance their cost structures, diversify revenue streams, and explore innovative strategies to remain competitive in the evolving Japanese and global aviation industry.

🔍 詳細

🏷 Impact of the Pandemic on ANA's Operations

#### Impact of the Pandemic on ANA's Operations

ANA (All Nippon Airways) has faced significant challenges due to the COVID-19 pandemic, leading to a sharp decline in financial performance. For the fiscal year ending March 2022, ANA reported revenues of approximately 740 billion yen, resulting in a loss of around 100 billion yen, marking the second consecutive year of losses after a 400 billion yen loss in 2020. The pandemic has also caused a drastic reduction in ANA's stock price, which has halved since the onset of COVID-19, reflecting decreased investor confidence. In response to these challenges, ANA plans to reduce its workforce from about 38,000 employees at the end of FY2020 to approximately 29,000 by FY2025, indicating a shift in operational strategy. Additionally, changing consumer behavior, particularly a decline in business travel due to the normalization of online meetings, has further impacted ANA's revenue potential. Despite these difficulties, ANA remains a leading airline in Japan, known for its innovative spirit and diverse business ventures beyond aviation.

#### Financial Challenges

- **Declining Stock Prices**: The pandemic has led to a significant drop in ANA's stock price, which has halved since the onset of COVID-19. This decline reflects a lack of investor confidence in the company's future prospects.

- **Workforce Reduction**: ANA plans to reduce its workforce from approximately 38,000 employees at the end of FY2020 to about 29,000 by the end of FY2025. This reduction indicates a shift in operational strategy post-COVID, as the company can no longer maintain its previous staffing levels. Employees have been reassigned to external companies, such as cabin crew working in call centers.

#### Strengths of ANA

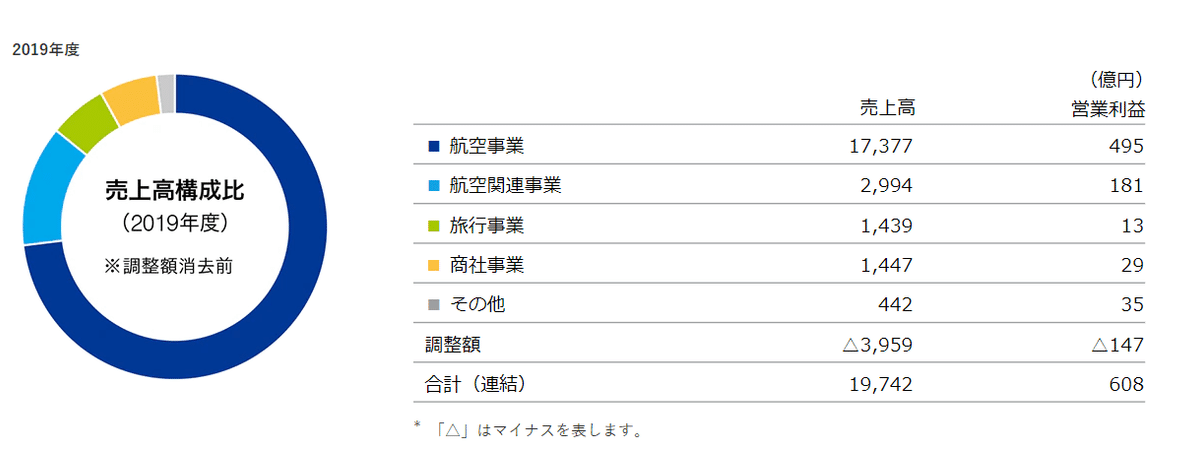

Despite the challenges, ANA remains a leading airline in Japan, with a competitive edge over its rival, JAL (Japan Airlines). In FY2018, ANA generated 2 trillion yen in revenue compared to JAL's 1.4 trillion yen.

- **Innovative Spirit**: ANA has a history of pioneering initiatives in the airline industry, such as the early adoption of web check-in services and the introduction of the Boeing 787, known for its superior handling and comfort.

- **Diverse Business Ventures**: ANA has expanded into various sectors beyond aviation, including advertising through its travel media. The airline utilizes its extensive customer contact points to offer advertising opportunities, providing a comprehensive service from planning to reporting.

#### Weaknesses of ANA

- **Financial Instability**: Compared to JAL, ANA has a higher level of debt, which poses a risk to its financial health. As of June 2020, ANA's interest-bearing debt stood at 1.3589 trillion yen, with a capital ratio of 33.9%, while JAL's figures were significantly lower.

- **Changing Demand**: The pandemic has altered consumer behavior, with a decline in business travel due to the normalization of online meetings. This shift has led many companies to reduce travel expenses, impacting ANA's revenue potential.

#### Conclusion

The COVID-19 pandemic has profoundly affected ANA's operations, leading to significant financial losses and operational changes. As the airline industry begins to recover, ANA's ability to adapt to changing consumer behaviors and economic conditions will be crucial for its future success. For more information on ANA's corporate structure and opportunities, visit [ANA Group](https://www.ana.co.jp/group/recruit/about-us/by-the-numbers/).

For further insights into the aviation industry, you can refer to the original article [here](https://note.com/manabel_syukatu/n/ne23423172263).

🖍 考察

### Investigation Results

The investigation reveals the following key points about ANA's recent performance and the airline industry landscape:

- ANA has faced significant challenges due to the COVID-19 pandemic, leading to sharp declines in financial performance, with losses of around 100 billion yen in the fiscal year ending March 2022. The pandemic has also caused a drastic reduction in ANA's stock price.

- In response to the challenges, ANA plans to reduce its workforce from about 38,000 employees to approximately 29,000 by FY2025, indicating a shift in operational strategy.

- Despite the difficulties, ANA remains a leading airline in Japan, known for its innovative spirit and diverse business ventures beyond aviation.

- Compared to its rival JAL, ANA has a higher level of debt and a less efficient cost structure, posing risks to its financial health.

- The pandemic has also altered consumer behavior, with a decline in business travel due to the normalization of online meetings, impacting ANA's revenue potential.

### Estimation

To address the gaps in the investigation results, the following estimation can be made:

- The decline in business travel demand due to the normalization of online meetings is likely to continue, requiring ANA to adapt its service offerings and pricing strategies to cater to the changing customer preferences.

- ANA's high debt levels and inefficient cost structure compared to JAL may hinder its ability to remain competitive in the long run, necessitating further operational restructuring and cost-cutting measures.

- The airline industry's recovery from the pandemic is expected to be gradual, with international travel demand potentially lagging behind domestic travel. ANA may need to focus on strengthening its domestic operations and exploring new revenue streams to offset the slow recovery in international travel.

- The entry of low-cost carriers and the need for more flexible pricing structures in the Japanese airline market present both opportunities and challenges for ANA. The company may need to adapt its pricing and service models to remain competitive.

### Analysis

Based on the investigation results and the estimation, the following analysis can be provided:

1. Operational Efficiency and Financial Health:

- ANA's high debt levels and less efficient cost structure compared to JAL suggest the need for further operational restructuring and cost-cutting measures to improve its financial health and competitiveness.

- The company should explore ways to streamline its operations, optimize its fleet, and enhance its overall operational efficiency to better navigate the post-pandemic landscape.

2. Changing Customer Preferences and Pricing Strategies:

- The decline in business travel demand and the need for more flexible pricing structures in the Japanese airline market present both challenges and opportunities for ANA.

- The company should closely monitor evolving customer preferences and adapt its service offerings and pricing strategies accordingly to cater to the changing market dynamics.

- Exploring new revenue streams, such as expanding non-airline businesses, may help ANA diversify its income sources and reduce its reliance on traditional passenger revenue.

3. Recovery and Growth Strategies:

- ANA's recovery from the pandemic is expected to be gradual, with international travel demand potentially lagging behind domestic travel.

- The company should focus on strengthening its domestic operations and exploring opportunities in the growing inbound travel market to offset the slow recovery in international travel.

- Investing in innovative technologies and digital transformation initiatives may help ANA enhance its operational efficiency and customer experience, contributing to its long-term competitiveness.

4. Competitive Landscape and Regulatory Environment:

- The entry of low-cost carriers and the need for more flexible pricing structures in the Japanese airline market present both challenges and opportunities for ANA.

- The company should closely monitor the competitive landscape and work with regulatory authorities to advocate for a more favorable operating environment that allows for greater pricing flexibility and market competition.

### Future Investigation

To further enhance the understanding of ANA's performance and the airline industry landscape, the following future investigation topics are recommended:

1. Comparative Analysis of ANA and JAL's Financial and Operational Strategies:

- Conduct a detailed comparison of the financial and operational strategies employed by ANA and JAL to identify best practices and areas for improvement.

- Examine the impact of JAL's post-bankruptcy restructuring on its profitability and operational efficiency.

2. Evaluation of ANA's Diversification Efforts and Non-Airline Businesses:

- Assess the performance and growth potential of ANA's non-airline business ventures, such as its advertising and travel media operations.

- Analyze the company's strategy for leveraging its customer touchpoints to expand its revenue streams beyond the core airline business.

3. Examination of the Japanese Airline Market's Regulatory Environment:

- Investigate the impact of the current regulatory framework, including the pre-approval system for fare changes, on the competitiveness and pricing dynamics of the Japanese airline industry.

- Explore potential regulatory reforms that could foster a more flexible and dynamic pricing environment, enabling airlines to better respond to market demands.

4. Analysis of Sustainable Aviation Initiatives and ANA's Environmental Commitments:

- Evaluate ANA's progress in achieving its sustainability goals, including the adoption of sustainable aviation fuel and the development of innovative technologies to reduce carbon emissions.

- Assess the company's efforts to align its environmental initiatives with global sustainability standards and industry best practices.

By addressing these future investigation topics, the analysis can provide a more comprehensive understanding of ANA's strategic positioning, the competitive landscape, and the industry's long-term sustainability, ultimately informing better-informed decision-making and strategic planning.

📚 参考文献

参考文献の詳細は、ブラウザでページを表示してご確認ください。